Walmart vs. Target: Only One Is Built For This Economy

Target Is Struggling. Walmart Isn’t. Here’s Why. Based on reporting by Louis Navellier, Editor, Growth Investor

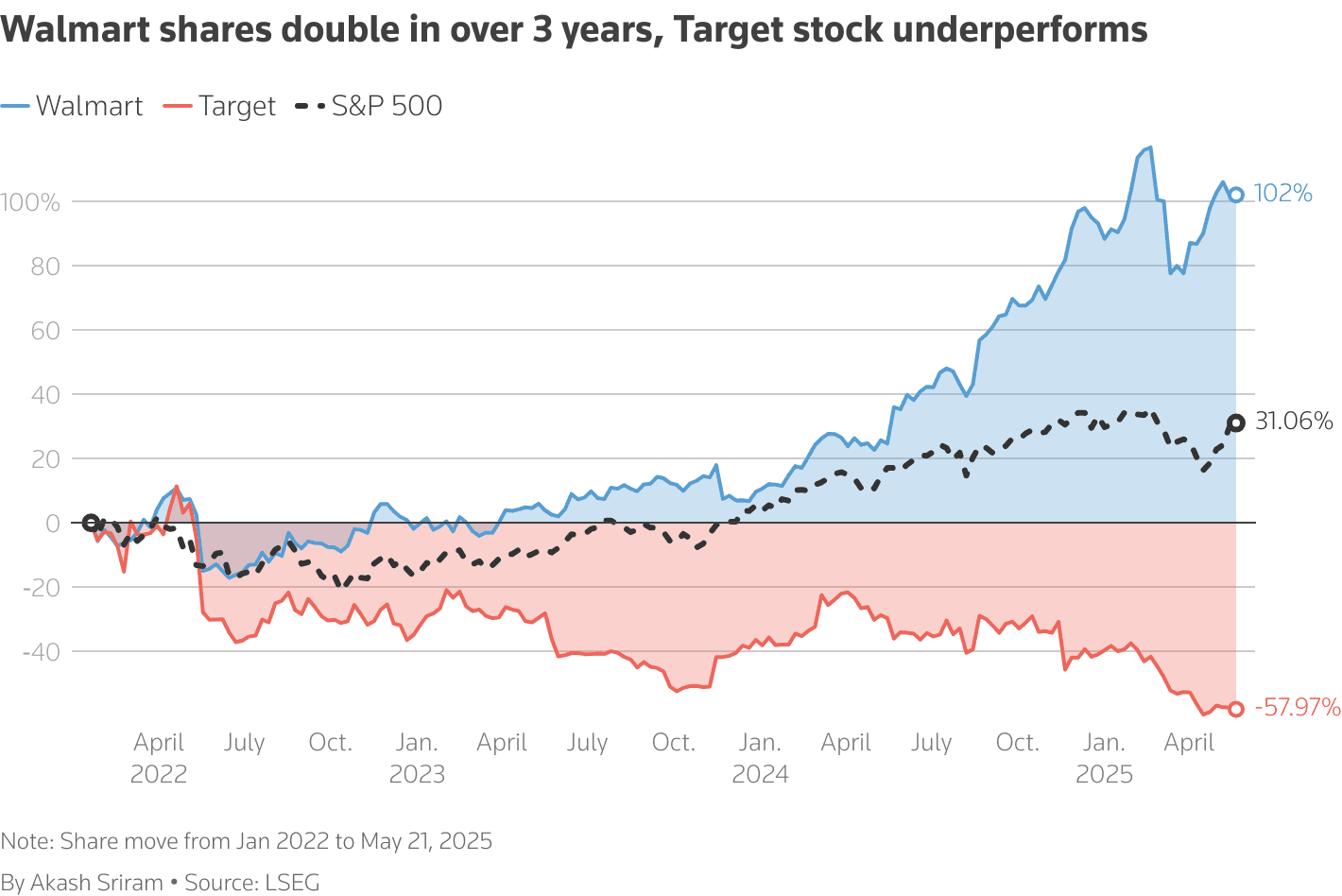

Target and Walmart reported earnings this week. Their numbers tell two completely different stories about retail—and the economy.

Target’s net revenue declined 1.5% year-over-year in Q3, continuing a now three-year trend of flat or negative sales. Same-store sales were down 1.43%, according to CenterCheck data. That’s not cyclical noise. That’s structural.

For 12 consecutive quarters, Target hasn’t been able to grow. It’s making leadership changes, cutting 1,800 jobs, increasing capital expenditures to $5 billion, and rolling out AI features in its app. But those moves haven’t addressed the core issue: Target’s merchandising and price position are misaligned with what today’s consumers want.

Target is still focused on discretionary categories—home goods, seasonal décor, and low-margin private label apparel. But consumer demand has shifted to essentials. Even during the holiday season, Target’s own executives admitted shoppers are “prioritizing what goes under the tree vs. what goes on it.” That’s a corporate way of saying people are buying gifts, not home items.

At the same time, consumers don’t believe Target offers the best price. And increasingly, that’s the only thing that matters. Competitors like Amazon and TJX are eating into its discretionary business. But the real threat is Walmart.

Walmart posted +4.5% same-store sales, with foot traffic up 1.8% and average ticket size up 2.7%. Total revenue grew 6% to $179.5 billion, exceeding expectations. CenterCheck’s adjusted retail sales index shows Walmart tracking at +2.48% same-store Y/Y, making it one of the best performers in the category.

Walmart’s pricing is clear. Its merchandising is focused on essential categories. It’s capturing demand from both ends of the income spectrum: lower-income households are defaulting to Walmart for affordability, and higher-income households are now trading down to Walmart for big-ticket value.

This bifurcated economy—what Navellier correctly calls a “K-shaped” recovery—is not theoretical. It’s showing up in store-level results. Target’s discretionary-heavy strategy is exposed. Walmart’s emphasis on scale, value, and efficiency is gaining share.

Beyond that, Walmart is executing digitally. Global online sales rose 27%, and its advertising business grew 53%. Its ChatGPT grocery integration and Walmart+ subscription product are driving frequency and retention. Target, in contrast, is just starting to test similar tools.

In the context of leasing strategy and asset value, these trends matter. Target’s soft traffic and declining sales raise concerns about co-tenancy, vacancy risk, and long-term positioning in power centers. Walmart, on the other hand, is increasingly acting as a stabilizing anchor—both for foot traffic and category resilience.

The takeaway is simple: in this economy, being known for value and essentials isn’t just a strategy. It’s a moat. Walmart has it. Target doesn’t.