Retail Sales Surge in March

Consumer spending roared back in March, posting its strongest month since early 2023, but the surge wasn’t rooted in economic optimism—it was a scramble. Faced with the prospect of sweeping tariffs set to take effect in April, U.S. households accelerated purchases across discretionary and essential categories, triggering what appears to be a one-month spike in retail activity.

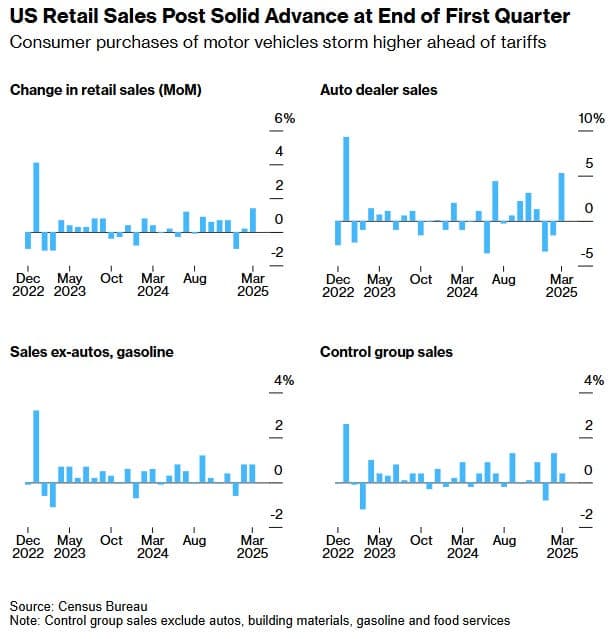

Retail sales rose 1.4% in March, led by durable goods categories that are especially sensitive to price volatility. Auto sales climbed 5.3%, the strongest monthly gain since the pandemic-era demand rebound. Building materials, furniture, and general merchandise categories also saw pronounced lifts, according to Census Bureau data released earlier this week.

“We’re seeing a very clear behavioral response to trade policy uncertainty,” said Dana Peterson, Chief Economist at The Conference Board. “Consumers are pulling forward purchases ahead of anticipated price hikes—not because they’re flush with confidence, but because they’re trying to stay ahead of cost increases.”

CenterCheck’s retail sales data confirms the trend. After two of the weakest months on record in January and February, where overall in-store retail sales dropped 0.6% and 0.4% respectively, March showed a broad-based acceleration. Card-based transaction volume grew 2.1% month-over-month across CenterCheck’s national panel of over one million locations, while average ticket size increased by 3.4%. The largest gains were observed in home improvement, discount general merchandise, and consumer electronics—sectors most exposed to tariff pass-through costs.

Retailers were hardly caught flat-footed. “We began to see a pricing reaction by mid-March,” said one sourcing executive at a national hardware chain. “Vendors warned us about Q2 increases tied to tariffs on Chinese steel, so we front-loaded orders and pushed customers to buy early. It worked.”

The Trump administration reintroduced a 25% tariff on a broad range of Chinese imports beginning April 3, including key consumer goods categories such as electronics, apparel, automotive parts, and household equipment. Additional levies on Mexican and Canadian goods were announced on April 4, with effective dates staggered into June.

Retailers are split in their response. Walmart, which sources heavily from tariff-impacted categories, signaled it would pass through a portion of price increases starting in Q2. Home Depot, meanwhile, has committed to keeping shelf prices stable for the near term by absorbing cost increases through supply chain offsets.

“The key is to look at April and May,” said Alicia Peterman, a retail sector analyst at Bank of America. “March looks strong on paper, but the forward curve doesn’t suggest durability. April is already reverting. Consumer sentiment is fragile.”

Indeed, April’s early transaction data shows that the March jump was an outlier. CenterCheck’s April card data shows a flatline: retail sales were up just 0.1% month-over-month, and average ticket size declined slightly—falling 1.2% compared to March highs. Volume has returned to pre-surge levels.

In macro terms, the Atlanta Fed lowered its Q2 GDP estimate from 2.1% growth to 1.2%, citing weaker real consumer spending and inventory drag. The jump in goods imports ahead of tariff implementation is also expected to widen the Q2 trade deficit. That data mirrors what CenterCheck observed: a spike in March spending, but no evidence of a structural shift in demand.

Retailers face a difficult Q2. Promotions may intensify, inventories are bloated in some categories, and tariff effects are still being priced in. If consumer behavior continues to shift from resilience to defensive posture—as it did in early April—some retailers may find themselves on the wrong side of the pull-forward effect.

For now, March was a win. But it wasn’t organic. It was policy-driven, fear-induced, and—by all accounts—fleeting. The bigger question is how consumers will behave when the prices they tried to avoid finally show up at checkout.