Data Centers Emerge as Investor Favorites in 2024: Mid-Year Acquisition & Disposition Trends

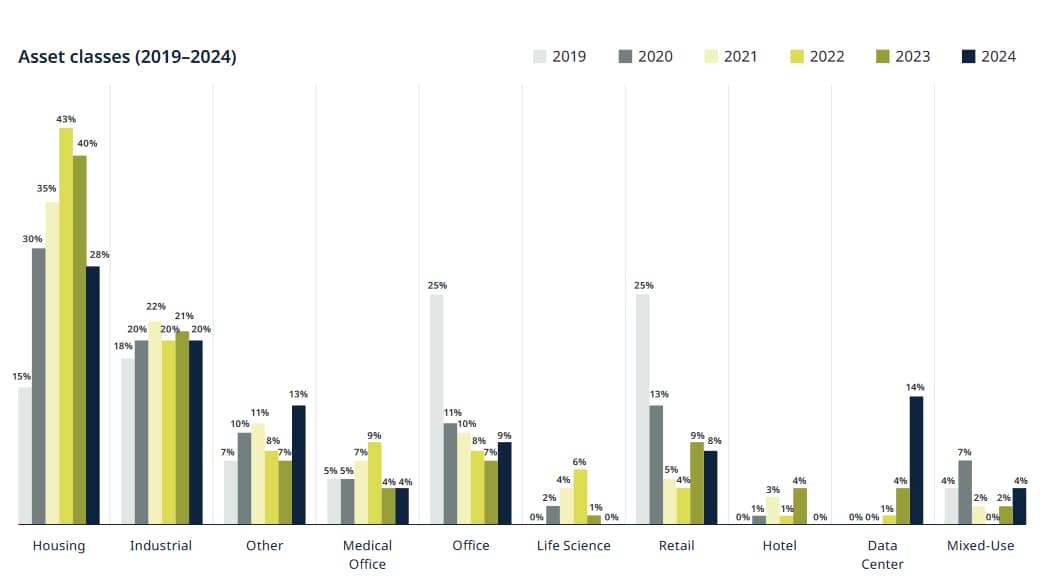

In the first half of 2024, data centers have solidified their position as the new darling of the investment world, according to DLA Piper’s midyear real estate trends report. Representing 14% of acquisition and disposition deals during this period, data centers have shown the largest growth among asset classes, up from a mere 4% in 2023. This meteoric rise is particularly striking when considering that just two years ago, data center deals were virtually nonexistent.

DLA Piper's findings align with a survey conducted earlier this year, where data centers emerged as the most attractive asset class, gaining more than 20 percentage points from the previous year. This surge reflects broader market trends, as more investors recognize the critical role data centers play in the increasingly digital economy.

While multifamily assets continue to dominate the market, followed by industrial properties, the rapid ascent of data centers is a clear indicator of shifting investment priorities. DLA Piper’s data center team has seen a significant increase in acquisition and financing activity, underscoring the sector’s growing appeal.

Acquisition and Disposition Trends

The DLA Piper report, based on over 850 acquisition and disposition agreements and more than 400 property management agreements, highlights several key trends shaping the real estate investment landscape in 2024. Notably, the first half of the year saw an increase in the percentage of data center and industrial properties where the construction fee was 5% or more. Approximately 60% of these deals carried a fee of 5% or more, while 40% were in the 3% to 4% range.

Other Findings

The report also sheds light on the performance of other asset classes. Office deals, which have struggled since the pandemic, showed a slight recovery, increasing from 7% in 2023 to 9% in 2024. However, this remains a far cry from 2019, when office assets accounted for 25% of acquisitions and dispositions.

Retail, once a significant player with 25% of the market in 2019, continued its downward trend, slipping from 9% in 2023 to 8% in 2024. Meanwhile, industrial assets have remained relatively stable, accounting for 20% of deals in 2024, consistent with previous years.

Longer Representation and Warranty Survival Periods

Another notable trend identified by the DLA Piper report is the extension of representation and warranty survival periods in commercial real estate transactions. A survival period defines the timeframe during which claims for breaches of reps and warranties can be made. The report found that 45% of transactions now have a survival period of 270 days, while 21% have periods extending to 365 days or longer. In contrast, shorter survival periods of 180 days have declined in frequency, dropping from 33% to 29%. 2024 Outlook

As we move through 2024, data centers are clearly on the rise, attracting significant investor interest and reshaping the real estate landscape. With longer survival periods in transactions and evolving trends across asset classes, it’s clear that the real estate market is adapting to new realities. For investors, recognizing these shifts and adapting strategies accordingly will be key to staying ahead in a rapidly changing market.