Boom or Bust? The Surprising Opportunities Hidden in Commercial Real Estate's Shifting Landscape

By Harris Trifon of Lord Abbett As we step into the latter half of 2024, commercial real estate (CRE) and commercial mortgage-backed securities (CMBS) markets are transitioning through the loan workout and distressed sale phases. Despite ongoing negative media sentiment, we at CenterCheck believe the underlying market presents opportunities for savvy investors. While secular challenges will persist in certain sectors, there are emerging trends that offer potential for growth and value, particularly for those with an eye on the evolving landscape of CRE.

Commercial Real Estate Market Outlook: Progress Amid Challenges

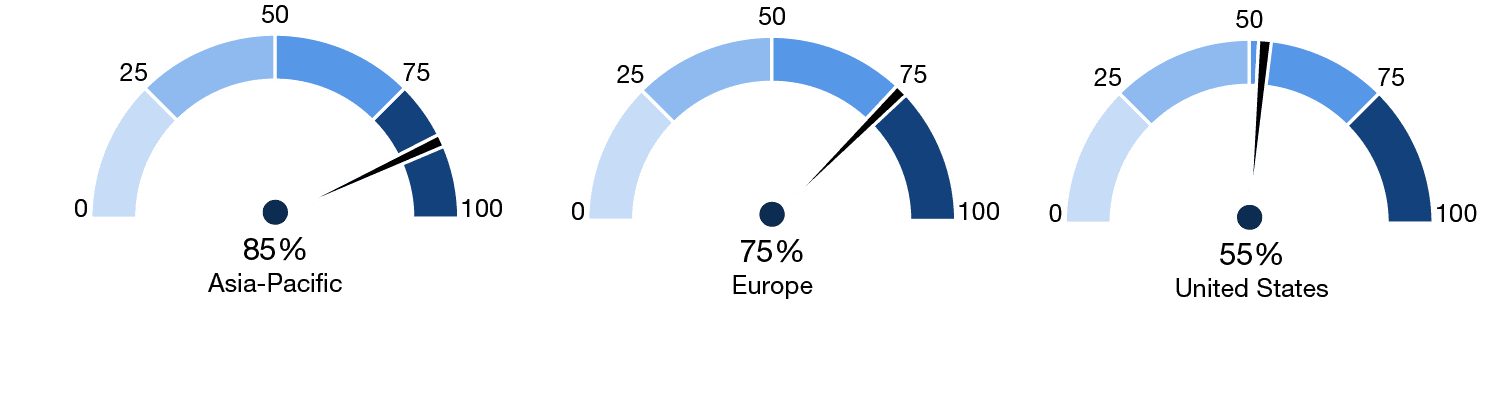

The office sector continues to grapple with getting employees back to their desks, especially in major U.S. cities, where utilization rates have stagnated at around 50%, according to JLL Research. By contrast, European and Asian cities have largely returned to pre-pandemic work habits (see Figure 1).

Since CRE values peaked in July 2022, several sectors within the RCA Commercial Property Price Index (CPPI) have seen declines between 10%-20%. Notably, the industrial sector has bucked this trend with an increase in value, while office properties in central business districts (CBD) experienced value drops of nearly 50% (see Figure 2).

Despite these declines, we believe certain areas of the market are poised for a recovery. Signs of this are already emerging, with distressed buyers beginning to reenter the market. For instance, 2024 has already seen transactions involving large office buildings in high-distress markets such as San Francisco. Further, companies like RXR and Ares have announced plans to invest in distressed office properties in New York City. Although property transaction volumes remain low (see Figure 3), we anticipate increased activity through the remainder of 2024 and into 2025.

Shifting Landscape of Loan Maturities

The CRE "maturity wall" has been a headline topic, particularly regarding CMBS and bank loans. As per Mortgage Bankers Association (MBA) data, maturities from last year have been pulled forward into this year by $270 billion, but maturities for 2033 and beyond have also increased by $150 billion in the last 18 months (see Figure 4). The outlook here is optimistic, as most lenders are actively working with borrowers to negotiate extensions, adding new equity, better loan structures, or recourse in exchange.

CMBS Loans: A Silver Lining

In the CMBS market, most maturing loans are in the single asset/single borrower (SASB) space, with 75% of these loans offering multiple extension options, according to Morgan Stanley (see Figure 5). The result has been a robust recovery in CMBS issuance volumes. Private label CMBS issuance has already exceeded 2023 levels, with projections indicating it may surpass 2022 figures by the end of this year. The current deal pipeline of $20 billion is the largest we’ve seen in nearly three years (see Figure 6).

That said, two areas of the CMBS market—CRE collateralized loan obligations (CLOs) and agency CMBS—have lagged behind. Issuers are dealing with higher delinquencies and wider credit spreads for non-AAA-rated liabilities. However, we don’t expect a turnaround in these sectors until 2025 at the earliest.

A Market in Transformation

Looking ahead to the second half of 2024, we expect the CMBS market to perform strongly, both on an absolute and relative basis. As the market continues to evolve, CenterCheck remains focused on identifying investment opportunities in primary and secondary markets.

In many ways, the CRE asset class is undergoing one of the most transformative periods in decades. Changes in how space is used, designed, and located are reshaping major cities across the globe. This dynamic has had significant implications for office spaces and shopping malls, which remain highly scrutinized in the media. However, we see other sectors, such as workforce housing, industrial warehouses, film studios, and data centers, as undersupplied and ripe for investment.

For investors willing to navigate these transformative times, the CRE market offers substantial opportunities for growth, diversification, and value creation. At CenterCheck, we believe in leveraging the latest data and trends to help our clients find the right investment strategies that capitalize on the shifting CRE landscape.

References:

- Data from JLL Research and Real Capital Analytics (RCA) as of May 31, 2024.

- Mortgage Bankers Association and Morgan Stanley data as of June 2024.