REITs Defy Market Trends with Record $23.3 Billion Raised in Q3 2024

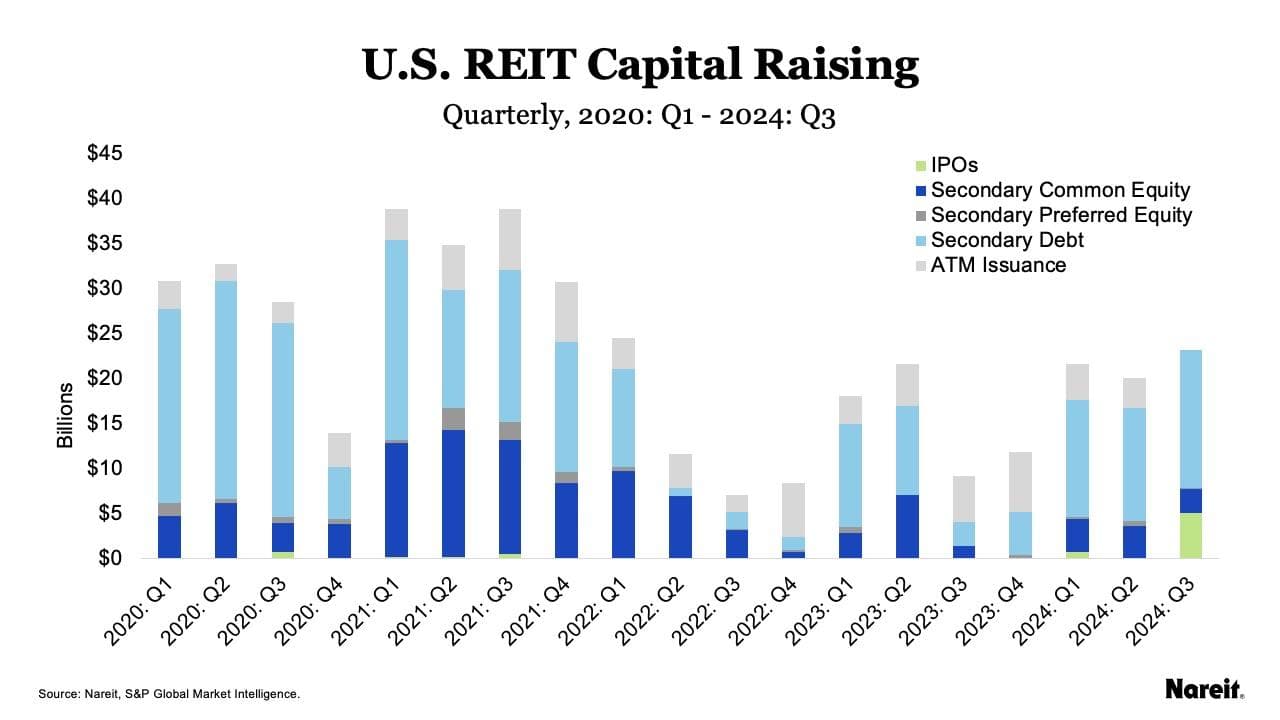

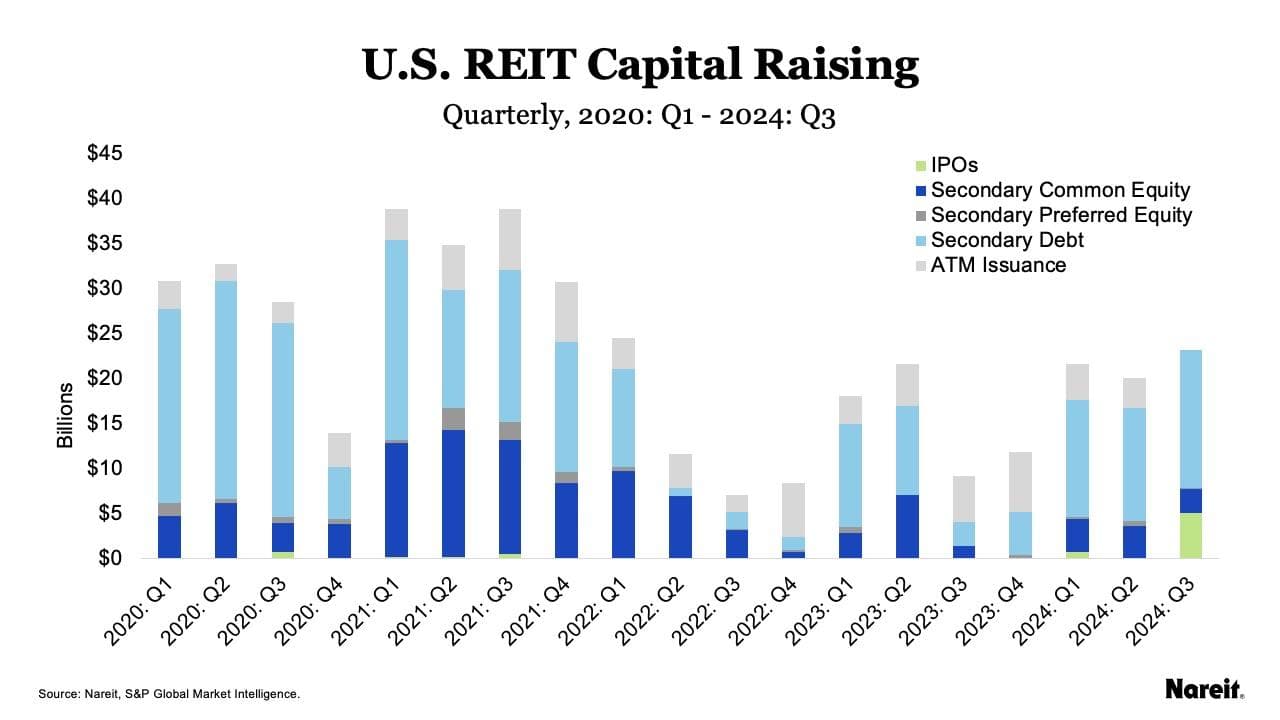

In a surprising twist amid a cautious economic landscape, U.S. real estate investment trusts (REITs) have raised an impressive $23.3 billion from secondary debt and equity offerings in the third quarter of 2024. This substantial capital influx includes $15.4 billion from debt offerings, $5.1 billion from a single initial public offering (IPO), and $2.8 billion from secondary common and preferred equity offerings. Notably, the July IPO not only stands as the largest of 2024 but also marks the biggest REIT IPO ever recorded.

This surge in capital raising underscores REITs' strong access to debt and equity markets, even as mergers and acquisitions (M&A) activity remains subdued. The third quarter saw no M&A deals, a stark contrast to previous years. So far in 2024, only one deal has been completed, valued at $9.2 billion. This is a significant drop from 2023, which witnessed $44 billion in announced acquisitions of publicly traded U.S. REITs.

Robust Capital Raising Amid Market Uncertainties

Year-to-date, REITs have issued $10.8 billion in equity, excluding at-the-market (ATM) offerings. This includes $9.9 billion from common equity and $921 million from preferred equity. By the second quarter of 2024, REITs had raised $7.4 billion through ATM offerings, slightly down from $7.8 billion in the same period of 2023 but contributing to the $19.6 billion raised throughout last year.

The capital issuance trend from the first quarter of 2020 to the third quarter of 2024 shows a significant uptick in debt offerings. Year-to-date, REITs have raised $40.8 billion through secondary debt offerings, substantially higher than the $23.9 billion raised during the same period in 2023. In the third quarter alone, debt issuance rose by 24% quarter-over-quarter, totaling $15.4 billion compared to $2.7 billion in the third quarter of 2023. The average yield to maturity for REIT unsecured debt offerings stood at 5.2%, with an average spread to similarly dated treasuries of 1.4%.

Muted M&A Activity Continues

M&A activity within the REIT sector remains notably quiet in 2024. Only one deal has been announced and completed this year, valued at $9.2 billion. This pales in comparison to 2023, which saw 11 announced deals totaling $44 billion, with 95% of that value reflecting acquisitions by listed REITs. In 2022, there were 10 deals announced, representing a total deal value of $83 billion.

Over the past three years, deals for 37 REITs were either announced or completed, amounting to $225 billion in acquisitions. Of this, 81% is attributed to acquisitions by other public REITs, highlighting a trend of consolidation within the industry.

Property Transactions Remain Subdued

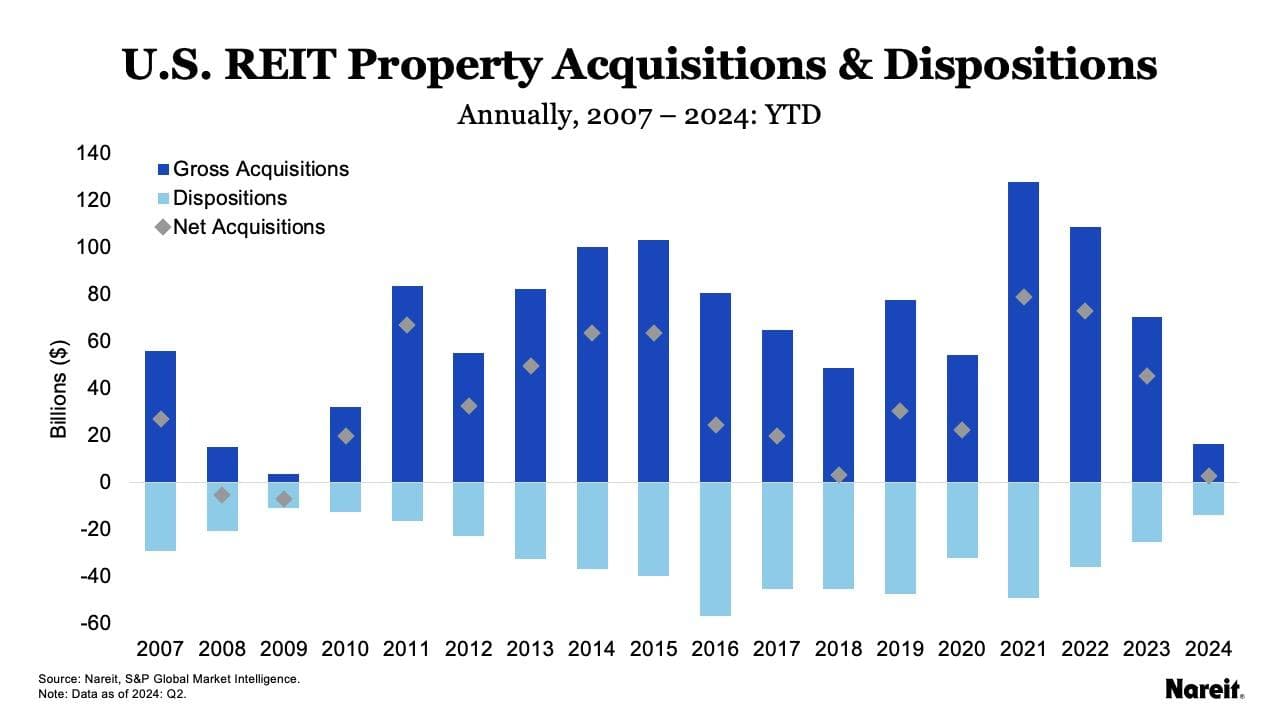

Property acquisitions in the second quarter of 2024 totaled $7.3 billion, with dispositions amounting to $6.1 billion. This is a significant decrease compared to 2023, which saw $70.7 billion in acquisitions and $25.7 billion in dispositions. The notable decline in both activities since 2022 indicates a cautious approach among investors amid economic uncertainties.

Despite the overall slowdown, certain sectors showed resilience. In the second quarter, health care, industrial, and retail led acquisitions with $1.6 billion, $1.5 billion, and $1.0 billion respectively. This suggests that investors are selectively targeting sectors with strong growth prospects and stable income streams.

Looking Ahead

The robust capital raising activity demonstrates that REITs continue to have strong access to debt and equity markets, even as property transactions and M&A activities remain muted. Investors appear confident in the REIT sector's ability to navigate current economic challenges, leveraging favorable debt conditions and tapping into equity markets to strengthen their financial positions.

As market conditions evolve, the REIT industry may see a resurgence in property transactions and mergers once stability returns. For now, the focus remains on capital raising and strategic positioning to capitalize on future opportunities.