Commercial Real Estate Market Recovery Gains Momentum in Q2 2024

The U.S. commercial real estate (CRE) market is showing signs of a rebound, according to the latest report from Colliers. As we move through 2024, investors are returning to the market, and volume increases in key sectors suggest that the downturn may be bottoming out. In Q2 2024, Colliers reported stronger-than-expected GDP growth, surging stock indices, and robust venture capital investments—all indicators of potential future job growth and a renewed demand for commercial space.

Major Investors Back in Action

One of the key takeaways from the second quarter is that major investors are re-entering the market, actively bidding on properties and acquiring portfolios. Investor sentiment indicates that now is a prime time to acquire commercial real estate, particularly as lenders begin offloading properties from their books, creating new opportunities for those with capital reserves. According to Colliers, "Near-record reserves are waiting to be deployed," with competition heating up between value-add and core-plus capital in certain asset classes.

Despite the positive trends, investors are still navigating a challenging borrowing environment. Cap rates appear to have peaked, but borrowing costs have left many investors facing negative leverage. However, as Colliers notes, "Historically, cap rates have been above borrowing costs," and the market may be shifting in favor of more favorable terms as the year progresses.

Sector Highlights: Multifamily, Office, and Industrial

Multifamily assets saw a major uptick in activity, with Q2 transaction volume reaching $38.8 billion, according to Colliers. This volume is in line with pre-pandemic averages, and major transactions like the $10 billion Blackstone/AIR privatization deal have broken the logjam in this sector. Although multifamily property prices declined 7.5% year-over-year, rent growth has returned, and absorption trends remain strong. Investors are now more confident in underwriting as market fundamentals rebalance.

In the office sector, price discovery is still underway, with transaction volume totaling $11 billion in Q2. Prices in this sector fell by 12.4% year-over-year, as many properties struggle with occupancy challenges. Buildings in some markets are trading for as low as $100 per square foot. Cap rates are generally in the 8-9% range, with some even hitting double digits. Despite these challenges, private capital remains active, and first-time buyers are stepping up with cash or low-leverage offers.

Industrial real estate continues to be a bright spot. Transaction volume hit $20 billion in Q2, with industrial property values growing 8% year-over-year. Institutional investors have made a strong comeback in this sector, and the fundamentals between supply and demand are returning to equilibrium. According to Colliers, cap rate compression has been observed in select markets, signaling strong investor confidence.

Retail and Hospitality on the Rebound

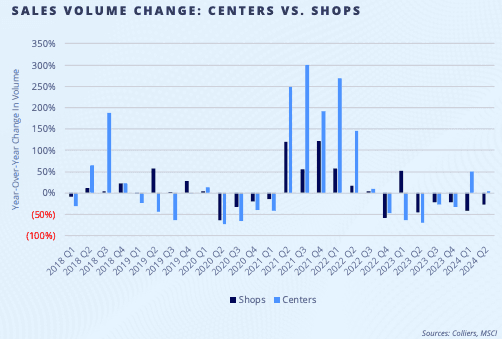

The retail sector, though still constrained, saw $9.9 billion in transaction volume. Shopping centers have posted back-to-back quarters of sales gains, while smaller retail shops have lagged. Fundamentals remain sound, with vacancies at decade lows and rising rents providing a strong foundation for future investment. Colliers also noted that street-level retail in prime areas like Fifth Avenue in Manhattan is experiencing renewed interest.

The hospitality sector is also showing growth, with $6.7 billion in Q2 transaction volume—a quarter-over-quarter and year-over-year increase. Larger-scale transactions, particularly in markets like Phoenix and Nashville, drove this growth. Luxury and upper-upscale properties are outperforming, and as travel demand continues to surge, particularly with record TSA screening numbers, hospitality is expected to remain a strong investment area.

Looking Ahead: Opportunities Amid Uncertainty

The start of the second half of the year has brought political and financial volatility, with election years historically slowing down investment activity. However, investors are keeping a close eye on the Federal Reserve’s actions, and many are anticipating rate cuts as soon as September. The recent fall in the 10-year Treasury has opened the door for refinancing opportunities, and the rest of 2024 may see a rush of activity as investors look to secure more attractive debt terms.

As we monitor market conditions through Q3 and Q4, CenterCheck is confident that commercial real estate is poised for recovery, with potential opportunities for buyers looking for neutral leverage and basis plays. Whether you are seeking value-add opportunities or portfolio acquisitions, the market is showing signs of stabilization, and the time to act is now.

Sources: Colliers, MSCI, CoStar