Walmart Momentum Cools As Wallets Tighten Further

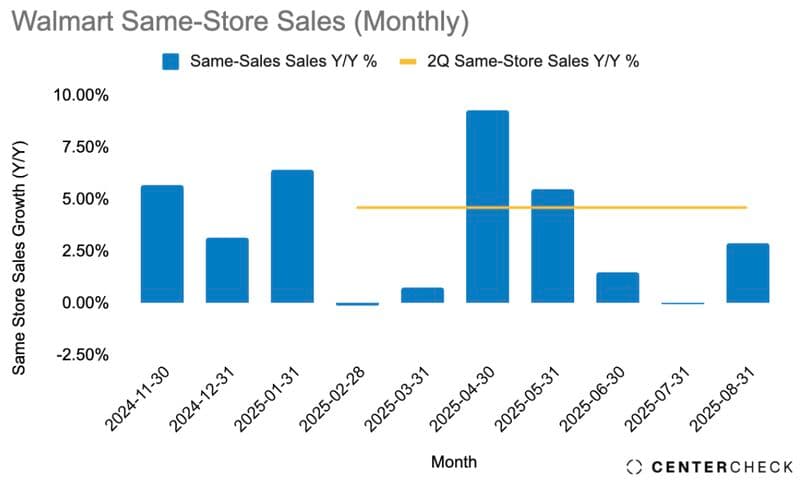

Costco’s numbers are in. Walmart’s aren’t yet. But CenterCheck data through August tells a clear story: same-store sales at Walmart are losing steam.

Q2 ended with a respectable +4.6% year-over-year comp, buoyed by a sharp spike in April, when store-level sales growth briefly exceeded 9%. But the monthly breakdown tells a more cautious story. Since that April peak, comps have decelerated. May and June both came in above the quarterly average, but just barely. July flattened. August rebounded slightly but remained well below the pace set earlier in the year.

For Q3, the trendline is unambiguous: monthly comps from August forward are tracking below Q2’s +4.6% run-rate. That makes Q3 the first quarter this year where Walmart’s same-store growth looks meaningfully softer — not negative, but clearly slower.

This isn’t collapse. It's normalization. But it matters. Walmart is the largest brick-and-mortar retailer in the U.S., and a bellwether for discretionary demand. When comps slow at this scale, it’s not just a Walmart story — it's a consumer story.

At the store level, CenterCheck data shows sharp geographic splits. Growth remains above average in high-volume suburban and exurban corridors, particularly in the Southeast. But comp softness is becoming more common in dense metro locations and in regions where SNAP benefits and tax credit buffers have faded. Seasonal shifts — including back-to-school — drove some of the lift in July and August, but not enough to reverse the broader deceleration trend.

The takeaway: even the biggest box in retail is no longer immune to consumer cooling. April’s outlier bump now looks like a high-water mark. Q3 will likely land below trend unless September delivers an unexpected surge — and right now, traffic patterns suggest it won’t.