Where Starbucks is Shrinking

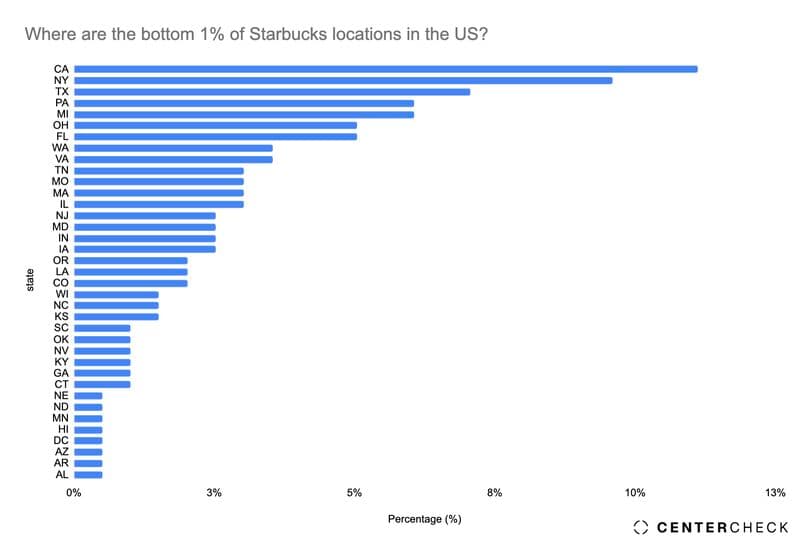

Starbucks will close roughly 1% of its North American stores this year, reversing a decades-long expansion streak. The move comes after six straight quarters of declining same-store sales in the U.S., driven by weakening urban foot traffic and rising consumer price resistance.

The closures are concentrated in high-CAM, labor-intensive locations—many in downtown cores. Foot traffic in these trade areas remains below 2019 baselines, particularly Monday through Wednesday. CenterCheck data shows weekday transaction counts are down 13% from 2022 across urban Starbucks units without drive-thrus. Many of these stores were built for commuter behavior that no longer exists.

At the same time, the brand’s value perception is deteriorating. Seventy percent of surveyed Starbucks customers now cite high prices as a reason to visit less often. That aligns with CenterCheck panel data showing a 7.2% drop in frequency over the last 12 months. Tickets remain elevated, but total transaction volume is sliding—and with it, unit-level profitability.

Starbucks’ competitive position is also under pressure. Chains like Dutch Bros and Blank Street are expanding with leaner formats and simpler menus. Independents have recovered post-COVID, especially in younger trade areas. To compete, Starbucks is cutting 30% of its menu, remodeling 1,000 stores, and shifting growth to drive-thru–oriented suburban units, where real estate is cheaper and volume more predictable.

For landlords, the implication is clear: store count alone no longer signals strength. Starbucks is exiting leases that no longer clear margin hurdles, particularly in dense, expensive markets. Future growth will favor operationally simple, car-accessible formats—not downtown storefronts.