US consumer spending posts first drop in almost two years

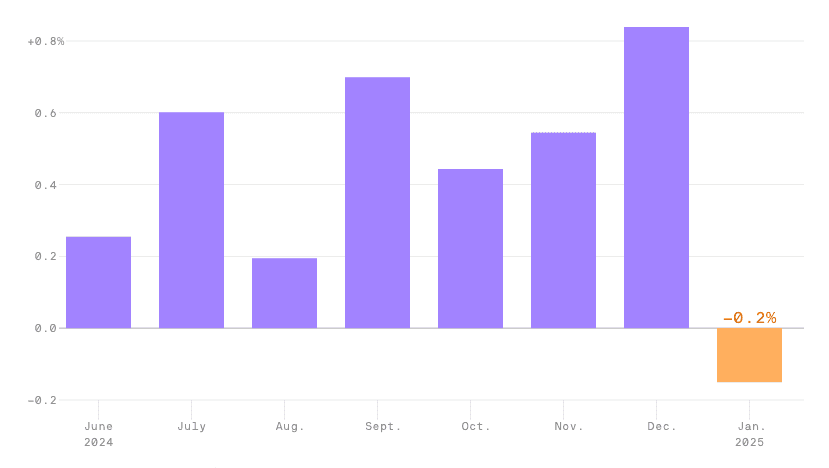

U.S. consumer spending declined in January for the first time since March 2023, marking a sharp pivot in the trajectory of the American economy—and CenterCheck data was among the earliest indicators to signal the shift. According to the Commerce Department, total personal consumption expenditures (PCE) fell 0.2% month-over-month, with inflation-adjusted (real) spending plunging 0.5%, the largest drop since February 2021.

This downturn comes on the heels of a robust December, when spending surged 0.8%, boosted by preemptive buying ahead of anticipated tariffs. But in January, that trend reversed, and consumers pulled back—particularly on goods, where spending dropped 1.2%, with notable weakness in automotive, apparel, home furnishings, and food and beverage retail.

CenterCheck’s high-frequency credit and debit card transaction data—which covers more than 70% of all U.S. consumer card swipes—confirmed the pullback in retail well before official reports. In fact, CenterCheck’s January sales data showed a 2.3% drop in same-store sales across apparel chains, a 1.9% decline in furniture retail, and softening transaction volume at grocery and convenience locations.

While services spending edged up 0.3%, led by housing and dining, even those gains were modest compared to prior months. Real-time CenterCheck data also revealed that customer frequency was down across most segments, suggesting consumers visited fewer stores and made fewer impulse purchases, especially in discretionary categories.

The broader context matters. Inflation remains sticky. The PCE price index rose 0.3% in January and is up 2.5% year-over-year, while core PCE (excluding food and energy) climbed 0.3% on the month and 2.6% on the year. Goods inflation rose faster than services, particularly for motor vehicles and gasoline, putting pressure on household budgets.

Despite rising costs, personal income actually jumped 0.9% in January, thanks in part to cost-of-living adjustments for Social Security recipients and a healthy 0.4% increase in wages. Yet the boost in income wasn’t enough to keep spending momentum alive. Consumers appear to be getting cautious again.

“CenterCheck’s live transaction data showed a clear January slowdown across both discretionary and essential categories,” said a spokesperson for CenterCheck’s research team. “Apparel, electronics, and home goods all took hits, while discount stores and dollar chains showed modest resilience. What we’re seeing aligns closely with the PCE data, but we saw it days—not weeks—in advance.”

The timing of this pullback couldn’t be more critical. Amid rising tariffs on Chinese, Mexican, and Canadian goods, businesses front-loaded imports in Q4. That drove the goods trade deficit to a record-high $153.3 billion, up 25.6% from December. But with January’s weak consumption, much of that inventory now risks sitting idle on shelves.

Despite the weakness in consumption, the labor market remains tight. Yet that might not be enough to offset growing consumer hesitancy, especially if inflation expectations rise. The savings rate rose to 4.6% in January, its highest level in seven months, suggesting Americans are starting to retrench.

The Federal Reserve now faces a classic conundrum. Inflation remains above target, but growth is sputtering. The Atlanta Fed slashed its Q1 GDP estimate from +2.3% to -1.5%, pointing to a potential contraction.

Markets are now pricing in a rate cut by June, anticipating the Fed will need to respond to weakening demand. But policymakers remain cautious, with tariff-related price pressures complicating the outlook.

January was a wake-up call. The American consumer—the engine of 70% of GDP—is tapping the brakes. And while the official data confirms it, CenterCheck's card-based analytics saw it first. When the economy slows, you don’t wait for a press release—you check the receipts.