Boutique Brokerages Thrive Amid Retail Real Estate Surge: Insights from ICSC

As the retail real estate market continues to grapple with demand outpacing supply, boutique brokerages are reaping the rewards of going independent, according to a recent report from the International Council of Shopping Centers (ICSC). Veteran brokers who have established their own tenant representation and agency leasing firms are finding their personalized, client-centric models give them an edge over larger national firms.

Executives from these boutique firms highlight their ability to foster close relationships and offer tailored solutions as a key differentiator. While many of these smaller firms concentrate on specific regions, their deep expertise and extensive networks allow them to handle deals on a national scale.

For example, Axiom Retail Advisors, launched in early 2022 by six principals, focuses heavily on Southern California but extends its reach to several Western states through a network of boutique brokerages. "We can be choosier with the assignments we take, which allows us to concentrate more deeply on deals and service clients at a much higher level,” said principal Terry Bortnick. This selective approach has enabled Axiom to help shopping centers reach full occupancy—recently increasing occupancy at California’s Marketplace Beaumont from 76% to 99% by securing a 25,000-square-foot HomeGoods.

Beyond the Deal

On the East Coast, Retail by MONA—launched during the pandemic in 2020—has seen exponential growth by sticking to a focused approach. Founded by former Cushman & Wakefield brokers Brandon Singer and Michael Cody, the New York-based brokerage anticipated little rebound but pressed forward nonetheless. “We doubled down on the city with the simple thesis that we really had nothing to lose,” Singer said. Their persistence paid off, with business beginning to pick up just months later. The firm has grown to 25 brokers and projects revenue to triple or quadruple this year after a similar boom in 2023.

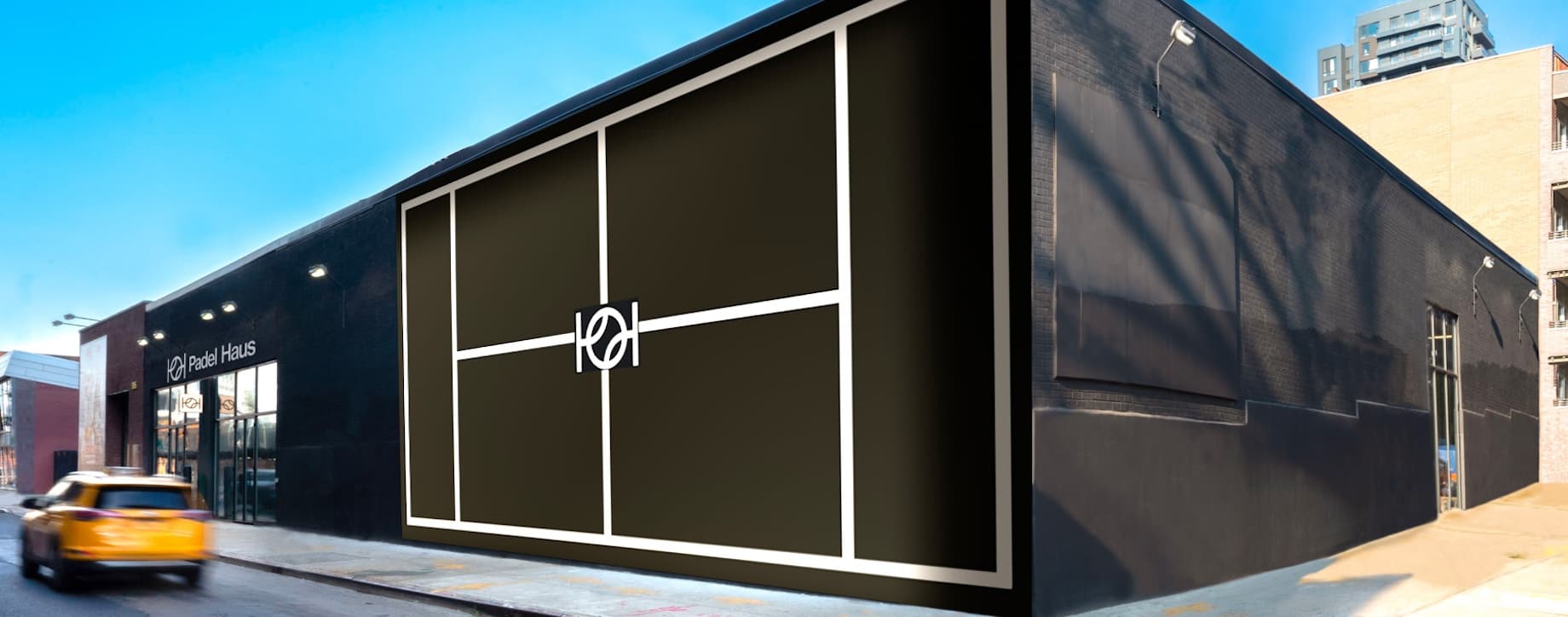

Retail by MONA credits its success to a team structure that avoids the competitive nature often seen at larger firms, focusing instead on industry sectors like food-and-beverage and luxury retail. This has led to deals such as leasing a 30,000-square-foot space in Brooklyn for upscale padel tennis concept Padel Haus, and securing a 9,000-square-foot space on Madison Avenue for French leather goods brand Maison Goyard.

Tailored Approach

While these boutique brokerages often focus on their home markets, they maintain a national presence by collaborating with local firms in other cities. Beta, founded in 2018 by former CBRE broker Richard Rizika, exemplifies this approach. Although based in Southern California, Beta was hired by DXL Big + Tall to represent the brand nationwide, thanks to its ability to identify the best real estate settings for the brand.

Boutiques like Axiom and Beta also serve as de facto asset managers for smaller property owners, offering strategic guidance on how to optimize their properties and secure the right tenants. “Not all shopping centers are owned by big Wall Street firms,” Bortnick explains. “A lot are owned by families or smaller companies, and we can make a real difference by bringing in the right tenants at the right rents.”

As demand for personalized service continues to grow, these boutique brokerages prove that a client-first, selective approach can offer a significant competitive advantage in today’s retail real estate market.