A Rising Tide of Red Ink: U.S. Office Mortgage Defaults Soar to Decade-High Levels

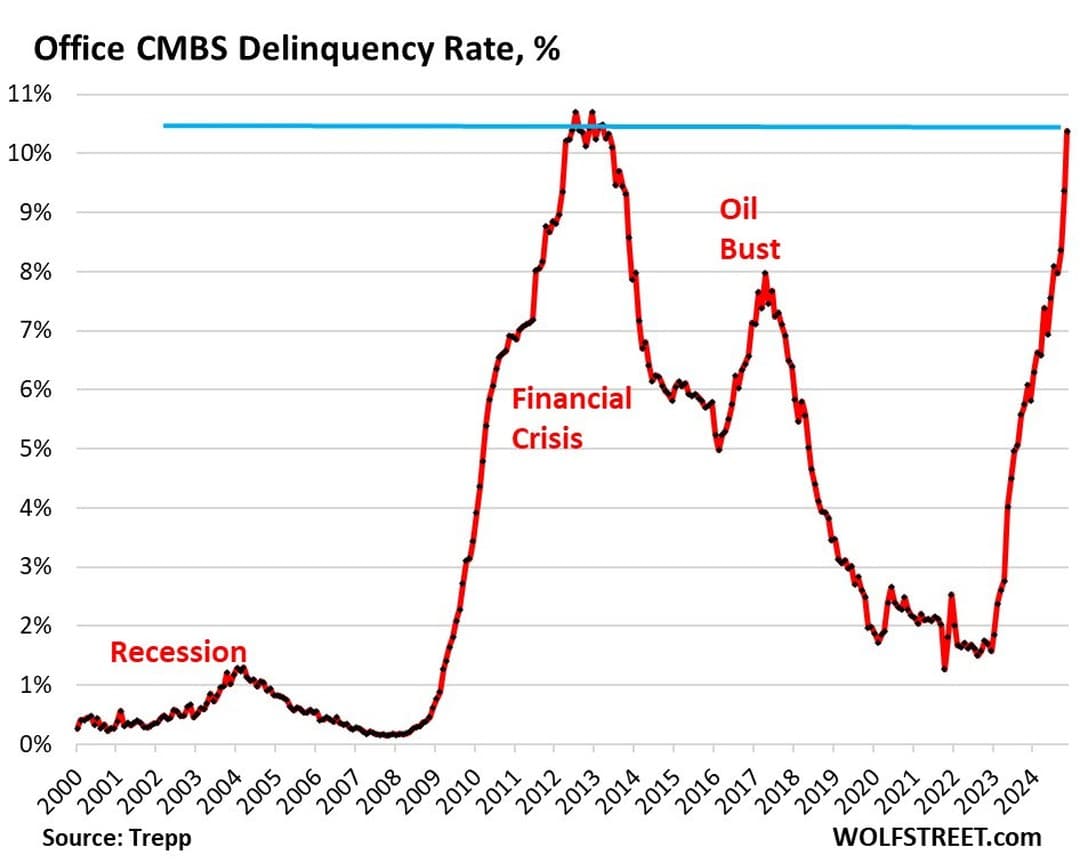

In Midtown Manhattan, a hulking 40-story office tower sits half-empty. The lobby still gleams with polished brass, and the security guards still greet tenants with a practiced nod, but the building’s owner is feeling the squeeze. The once-coveted asset—purchased at the height of the market—now stands as a symbol of a commercial real estate reckoning few could have predicted a decade ago. According to data shared by Global Markets Investor, the delinquency rate on U.S. commercial mortgage-backed securities (CMBS) for office properties hit 10.7% in October, the highest since 2012. Even more troubling is the speed of this rise: office CMBS delinquencies have now climbed faster than they did during the Great Financial Crisis, a financial cataclysm that many in the industry hoped would remain a historical footnote.

It’s not just anecdotal. Trepp, a leading provider of CRE market analytics, confirms that the office sector is bearing the brunt of a shifting economic landscape. At the height of the pandemic, many predicted a rebalancing of office space use—perhaps more flexible leases and coworking hubs. But what’s happening goes beyond a mere cyclical downturn. The sustained popularity of remote and hybrid work models, rising interest rates, and tighter lending standards have combined into a perfect storm. What once appeared to be a temporary disruption has calcified into a structural shift in office demand.

“These delinquency rates are alarming,” says Lisa Pendergast, Executive Director of the CRE Finance Council. “We’re not just talking about a few distressed assets. We’re talking about systemic changes in how office spaces are being used—or not used—in the United States.” In the third quarter of 2023, the Mortgage Bankers Association reported that more than 20% of office loans maturing by year-end faced significant refinancing challenges, as borrowers and lenders failed to reconcile old valuations with new market realities. Property owners who once enjoyed low-cost debt now face the grim prospect of balloon payments they can’t refinance at favorable terms, thanks to interest rates hovering near two-decade highs.

Historically, CMBS loans provided a lifeline for office owners. During boom times, these packaged loans, sold to investors seeking steady interest streams, enabled rapid development and high valuations. But as vacancies rise—Manhattan’s office vacancy rate was hovering around 15-16% by mid-2024, according to JLL—those anticipated rental incomes are drying up. Lower rents mean less net operating income. Less income means less ability to service debt. Less ability to service debt translates directly into more delinquencies. It’s a vicious cycle.

But this downturn isn’t confined to New York. In San Francisco, high-profile towers once filled with tech giants are struggling to retain tenants as companies downsize and sublease excess space. In Chicago, older “commodity” office buildings—structures that lack the amenities or modern features that post-pandemic tenants now demand—are languishing. Nationwide, lenders are increasingly nervous. A new Fed survey shows more than 40% of banks tightening credit standards on commercial real estate loans, a higher figure than at any point since the post-2008 aftermath.

“Office landlords are under siege from multiple angles,” explains Jim Costello, chief economist at MSCI Real Assets. “First, tenants are still rethinking their footprints—some want half the space they leased three years ago. Second, the debt they took on at 3% interest is coming due in a world of 6-7% rates. Finally, investors who once prized office CMBS are now on the sidelines or demanding steep discounts.”

The rising delinquencies aren’t just a number. They signal a potential wave of foreclosures and distressed sales. Already, some major players have walked away from office towers, handing the keys back to lenders rather than pouring more cash into a losing venture. Brookfield, one of the world’s largest real estate investors, made headlines earlier this year when it opted to default on loans tied to office properties in Los Angeles rather than continue bleeding money.

For local economies, the fallout could be significant. Municipalities rely on property taxes from these office buildings for a big chunk of their budget. As valuations drop and tax appeals multiply, city coffers could take a hit. There’s also a knock-on effect for retail and hospitality sectors that rely on the daily foot traffic office workers generate. Cities like Washington D.C. and Boston have already noted softer lunch crowds, emptier hotels on weekdays, and declining revenue from transit fares.

Is there a silver lining? Some analysts suggest that distress could yield opportunity. Owners with capital might scoop up assets at bargain prices and reposition them—converting old office floors into apartments, hotels, or mixed-use community hubs. While such conversions are often complicated by zoning rules, construction costs, and design limitations, a few successful case studies have emerged. For instance, in Calgary, where the office vacancy rate soared above 30%, the local government offered incentives for office-to-residential conversions, and developers jumped at the chance.

Still, the scale of the challenge dwarfs any quick fixes. Office landlords are collectively grappling with hundreds of billions of dollars in loans maturing over the next two years, all while demand for traditional office space continues to lag pre-pandemic levels by 10-20%, depending on the market. The next few quarters could reveal just how bad it gets. If refinancing proves too burdensome, or if tenants keep shrinking their footprints, that 10.7% CMBS delinquency rate might just be an early warning sign.

As one veteran broker in Los Angeles put it: “We survived the dot-com bust, 9/11, and the Great Financial Crisis. But what’s happening now feels different. It’s not just a downturn—it’s a reset of how we use and value office space.” That reset is reverberating through the entire commercial real estate ecosystem, threatening to reshape America’s city skylines and shaking the confidence of investors who once believed office buildings were as safe as houses. For now, all eyes remain on the numbers—vacancy rates, leasing velocity, refinancing costs, and, of course, that climbing CMBS delinquency figure. If the latter keeps ticking upwards, the office sector’s reckoning may have only just begun.