Why Real Estate Has Been So Slow to Embrace Technology—and What’s Changing

Why Real Estate Has Been So Slow to Embrace Technology—and What’s Changing

In an era when industries from finance to healthcare have raced to digitalize their operations, the real estate sector—a multi-trillion-dollar behemoth—has been curiously slow to adapt. For years, the processes of buying, selling, and managing property hardly budged from their analog roots: reams of paperwork, in-person showings, and pen-and-paper negotiations were the norm. By contrast, consumers today can manage their banking, telehealth appointments, and even grocery shopping via a smartphone, leaving many to wonder: Why has the real estate industry resisted the tech revolution for so long?

Several forces have begun to shift this dynamic, but understanding why real estate has historically lagged behind can explain both the challenges and the opportunities that lie ahead.

1. Complex Stakeholder Ecosystem and Fragmented Processes

Few industries involve as many layers of stakeholders as real estate. Buyers, sellers, tenants, landlords, brokers, title companies, notaries, lenders, inspectors, government agencies—the list goes on. Each has its own set of rules, paperwork, and compliance requirements. A 2024 Deloitte study found that over 70% of real estate transactions in the U.S. still required multiple parties to physically sign documents at different phases, creating a labyrinthine environment that isn’t easily streamlined by a single technology solution.

“Real estate is not a monolith,” explains Sara Chen, Director of Innovation at a mid-sized property management firm. “It’s really hundreds of little processes involving scores of decision-makers, each with different incentives and levels of risk tolerance. Throw in local, state, and federal regulations, and you end up with a puzzle that’s been resistant to one-size-fits-all tech.”

2. Tradition and Relationship-Driven Culture

A second factor is the industry’s deeply rooted culture of personal relationships and tradition. For decades, success in real estate hinged more on a broker’s Rolodex, local knowledge, and face-to-face negotiations than on data analytics or automated workflows. Homebuyers want to “kick the tires” of a property; landlords want to meet their prospective tenants; brokers often thrive on the personal rapport they build with clients.

“Buying a home is emotional,” says David Mantle, a broker with 30 years of experience in a suburban Chicago market. “Technology can’t replace the handshake, the gut feeling, or that intangible sense of trust many clients seek in a realtor. It’s why so many of us were slow to adopt digital tools—we believed it stripped away the personal side.”

This tradition-bound culture also meant that many legacy players saw little impetus to innovate. The status quo was working well enough—commissions remained healthy, and property values were rising. Why fix what wasn’t broken?

3. High-Stakes Transactions and Low Appetite for Risk

Real estate transactions typically involve substantial sums of money and high emotional stakes—buying a home is often the largest purchase people make in their lifetimes. That has historically discouraged experimentation. A faulty piece of software that overestimates a home’s value or mismanages a contract can translate into multimillion-dollar liabilities, lawsuits, or regulatory woes.

“Banks and insurers are risk-averse, and the same goes for traditional brokerage houses,” notes Linda Schwartz, Senior Analyst at PropTech Watch. “Many of them didn’t see the upside in adopting technology that wasn’t battle-tested, fearing a single bug could collapse a deal. This reticence became a major barrier to widespread adoption, even as other industries embraced agile and iterative tech improvements.”

4. Regulatory Complexity and Paper-Heavy Processes

Real estate transactions must adhere to a tangle of government regulations—from local zoning ordinances and state property laws to federal disclosure mandates and consumer protection statutes. Each region can have wildly different processes, requiring specialized forms and compliance checkpoints. This complexity has made it difficult for a single tech platform to offer a national or global solution.

“Before a new piece of software can streamline your entire transaction, it has to be legally valid in hundreds of jurisdictions,” says Neil Araujo, CEO of a real estate document management startup. “And real estate law changes constantly. Each revision to a local ordinance or lender requirement can upend your code, forcing repeated updates to remain compliant.”

Additionally, real estate remains notorious for extensive paper trails—deeds, disclosures, mortgage notes, and more. E-signatures and digital filing have made strides, but the 2024 National Association of Realtors (NAR) survey found that over 55% of realtors still rely on at least some physical paperwork for major steps of the transaction. Overcoming decades of entrenched bureaucracy is no small feat.

5. Slow-But-Steady Tech Adoption: The Shift Has Begun

Though late to the digital party, the tide is finally turning. Investors poured $21 billion into PropTech startups globally in 2023, per CREtech data, and the momentum continued into 2024. From iBuying and fractional ownership platforms to advanced analytics software for property managers, the sector is seeing a flurry of new ideas.

“What’s driving it now is partly generational,” notes Chen. “You have more millennial and Gen Z homebuyers and renters who expect everything to be accessible online. They don’t blink at doing virtual tours or e-signing documents. On the commercial side, institutional investors are increasingly demanding data-driven insights and real-time dashboards to monitor their portfolios.”

Moreover, COVID-19 sped up the conversation: remote closings, virtual showings, and digital notaries became necessary workarounds during lockdowns, highlighting the inefficiencies of in-person processes. Firms that survived the pandemic realized technology wasn’t a luxury, but a foundational element for continuity.

6. Technology’s Benefits: Efficiency, Transparency, and Cost Savings

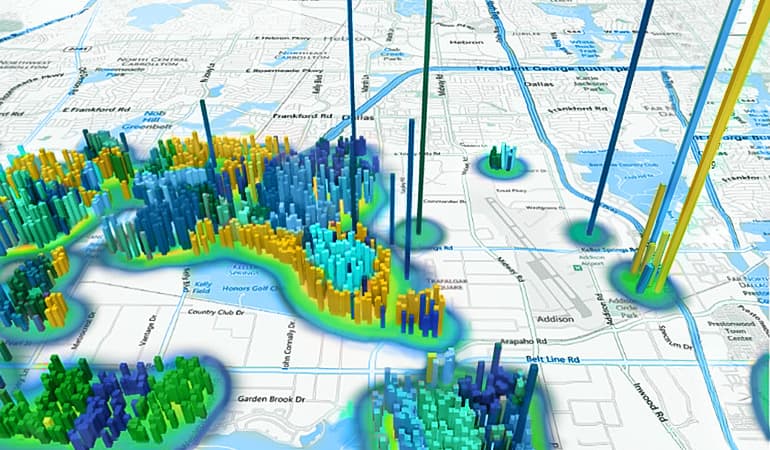

Where real estate tech does gain a foothold, the benefits are evident. Automated workflows and e-signatures can shave weeks off a typical closing. AI-driven property valuation tools increase accuracy and reduce the subjectivity of traditional appraisals. Virtual reality showings allow out-of-town buyers or renters to tour listings from anywhere, broadening the market. And with data analytics, commercial landlords can optimize leasing strategies, adjusting rents or marketing tactics based on real-time foot traffic or consumer spending patterns.

A 2025 study from Deloitte found that brokerages adopting digital transaction management platforms saw an average of 13% higher deal velocity and a 7% reduction in administrative overhead. “These margins matter in a tight, competitive marketplace,” says Mantle. “Even the old-school folks see that we can’t just rely on handshakes anymore.”

7. Where Does It Go from Here?

As 2025 unfolds, analysts predict a snowball effect. As more transactions successfully integrate technology, trust in these platforms grows, and the pace of adoption accelerates. Younger professionals entering real estate expect digital tools as a baseline, and consumer preferences lean toward convenience. Meanwhile, funding continues to flow into PropTech, fueling ongoing innovation that tackles once intractable regulatory and cultural roadblocks.

Yet it won’t be an overnight transformation. Skepticism lingers, and no single platform has yet united the industry under one digital umbrella. Different markets will adopt at different paces, and the inherent complexities of local law, custom, and tradition will remain hurdles.

Still, the question is no longer if real estate tech will disrupt the industry, but how quickly it will become the norm. As Chen puts it, “We’re basically in Act II of a multi-act play. The initial skepticism has given way to cautious optimism, and the industry is starting to rewrite how people buy, sell, and manage properties. That’s a big culture shift—but it’s happening.”

In an industry historically resistant to rapid change, any shift in pace is notable. And with the stakes of every transaction so high, those who adapt could set new standards for efficiency, transparency, and global reach—heralding a future where real estate finally catches up to the tech-savvy world around it.