Real Estate Economists Predict Recovery by 2025

Real estate economists are expressing increased optimism about the U.S. economy and real estate markets, anticipating a soft landing and a recovery beginning in 2025. The Urban Land Institute's (ULI) Fall 2024 Real Estate Economic Forecast—a semiannual survey of economists and analysts—indicates that strong economic data and stabilizing real estate values are bolstering confidence in the near-term outlook.

After years marked by heightened recession fears, the latest survey results no longer foresee a slowdown in economic performance. The forecasts align closely with long-term historical averages, suggesting that the economy is poised for steady growth rather than a downturn. Predictions for annual GDP growth and employment have both increased compared to the Spring 2024 survey. Additionally, respondents expect slightly lower 10-year U.S. Treasury rates as the Federal Reserve begins to reduce interest rates.

Key Findings:

- Economic Growth and Employment: Economists project the U.S. economy to perform at or above historical averages in the near term. Annual GDP growth is expected to be 2.5% in 2024 and 2.0% in both 2025 and 2026, slightly higher than previous forecasts. Employment growth forecasts have also risen, with an expected addition of 2.3 million jobs in 2024 and 1.6 million in 2025.

- Interest Rates and Inflation: Lower interest rates are anticipated to kickstart a recovery in real estate performance and thaw capital markets. The year-end 10-year U.S. Treasury rates are forecasted to be 3.8% in 2024, down slightly from earlier predictions. Inflation, measured by the Consumer Price Index (CPI), is expected to moderate, ending 2024 at 2.6% and further decreasing to 2.3% by 2026.

- Real Estate Values and Returns: Real estate values are expected to reach their lowest point in 2024 and begin recovering in 2025 and 2026. The MSCI Real Estate Property Index (CPPI) is projected to remain flat in 2024, an improvement from earlier forecasts of a decline. Appreciation forecasts have increased for the following years, boosting return expectations for both private and public real estate indices. The NAREIT All Equity REITs index is expected to return 15% in 2024.

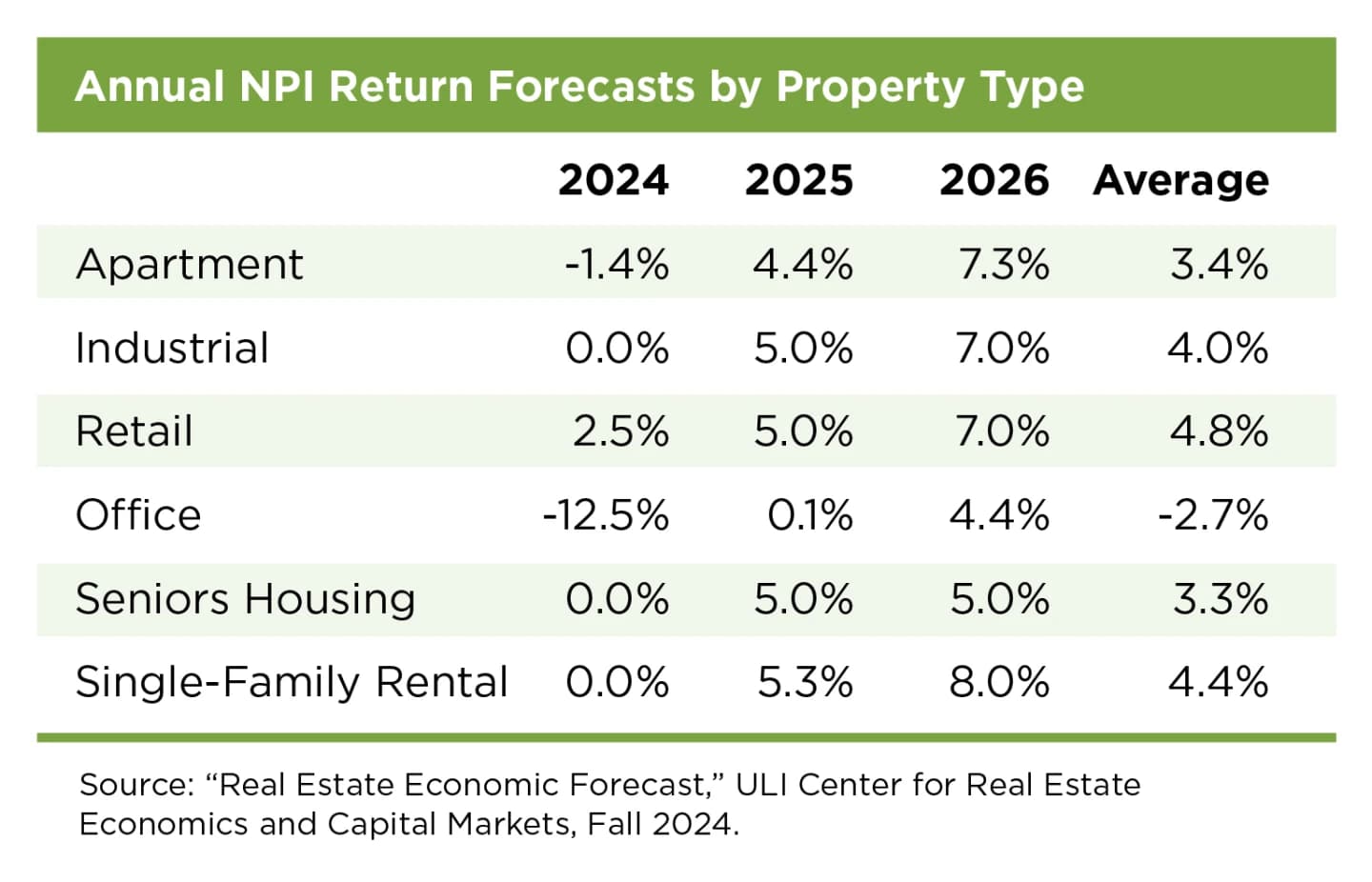

- Sector Performance: Return forecasts have improved for retail, industrial, and apartment sectors, while the office sector continues to face challenges. Retail properties are expected to have the highest average annual returns at 4.8%. Industrial and apartment sectors follow with expected returns of 4.0% and 3.4%, respectively. The office sector is projected to experience negative returns, averaging -2.7% through 2026.

- Capital Markets Activity: Lower interest rates are expected to revive real estate capital markets. Forecasts for commercial mortgage-backed securities (CMBS) issuance have increased significantly, with expectations of $85 billion in 2024, rising to $110 billion in 2025 and $120 billion in 2026. However, forecasts for commercial real estate transaction volumes have moderated slightly.

- Rent Growth and Vacancy Rates: Rent growth forecasts vary by property type. Industrial properties lead with an average annual rent growth projection of 3.6%. Apartments and retail properties are expected to see rent growth of 2.7% and 2.6%, respectively. Office rent growth remains modest but positive at 0.2% annually. Vacancy rates for industrial and retail properties are expected to rise but remain below long-term averages. Apartment and office vacancies are forecasted to remain above historical averages but show signs of improvement.

- Residential Construction and Home Prices: Single-family housing starts are expected to remain strong, exceeding historical averages. Starts are predicted to reach 975,000 units in 2024, increasing to 1.1 million by 2026. Home prices are anticipated to rise by 4.8% in 2024 before tapering to increases of 4.0% and 3.7% in the following years.

Conclusion:

The ULI Real Estate Economic Forecast reflects a notable shift toward optimism among economists and analysts. Improved economic indicators, expectations of lower interest rates, and signs that real estate values are nearing their trough contribute to the positive outlook. While challenges persist—particularly in the office sector—the overall sentiment suggests that the U.S. economy and real estate markets are on a path toward recovery, with growth anticipated to solidify in 2025 and beyond.

About the Forecast:

The ULI Real Estate Economic Forecast is produced by the ULI Center for Real Estate Economics and Capital Markets. The Fall 2024 survey was conducted from September 18 to October 4, encompassing responses from 36 economists and analysts at 28 leading real estate organizations. The forecast presents median responses, reflecting a range of views within the industry.