October Retail Sales Exceed Expectations, September Spending Revised Sharply Higher

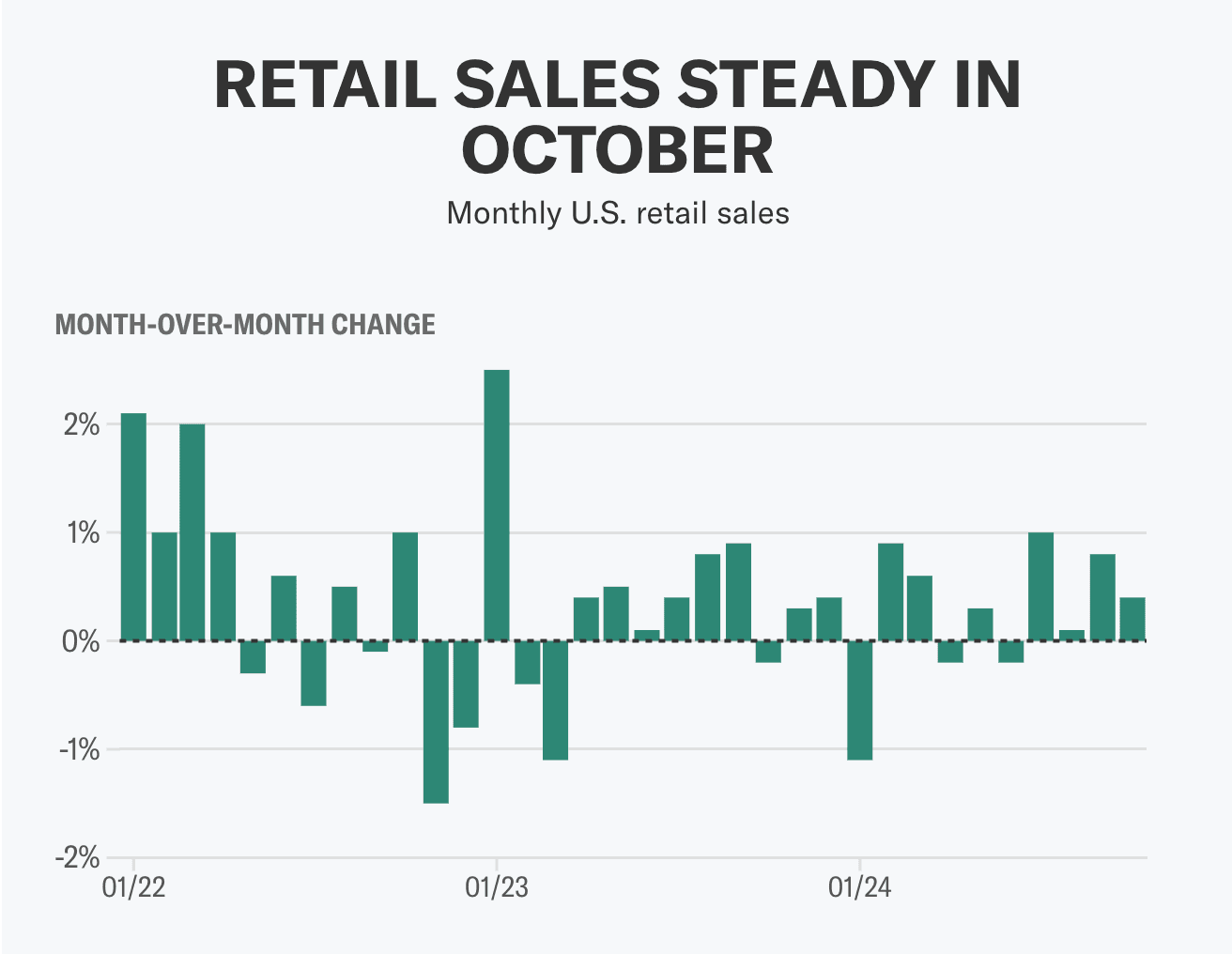

In a display of continued resilience among American consumers, retail sales in October grew more than anticipated, signaling steady economic momentum as the year approaches its end. The Census Bureau reported that retail sales rose by 0.4% in October, surpassing economists' expectations of a 0.3% increase, according to Bloomberg data.

Adding to the optimistic outlook, September's retail sales were significantly revised upward to show a 0.8% increase, double the previously reported 0.4% rise. This substantial revision indicates that consumer spending was stronger than initially believed, providing a solid foundation for economic growth in the fourth quarter.

A major contributor to October's gains was the auto sector, with sales increasing by 1.6%. However, when excluding autos and gas, retail sales edged up just 0.1%, falling short of the 0.3% growth economists had predicted. The control group, which strips out volatile categories and directly feeds into gross domestic product (GDP) calculations, unexpectedly decreased by 0.1% in October, missing forecasts of a 0.3% rise.

Despite the softer numbers in some categories for October, the upward revisions for September suggest that consumer spending remains robust. Bradley Saunders, North America economist at Capital Economics, remarked that "the underlying weakness in October’s retail sales was accompanied by an upward revision to September’s gain, suggesting that consumption growth is still going strong."

Kathy Bostjancic, chief economist at Nationwide, echoed this sentiment, stating that the latest retail sales data shows "consumers maintained upbeat spending momentum" at the start of the fourth quarter. She predicts another "solid" quarter of U.S. economic growth to conclude 2024.

These figures come as investors closely monitor the health of the U.S. economy and the Federal Reserve's approach to its interest rate policy. To date, economic data has largely exceeded expectations, leading markets to adjust their views on the timing and pace of potential interest rate cuts.

In prepared remarks on Thursday, Federal Reserve Chair Jerome Powell emphasized caution, saying, "The economy is not sending any signals that we need to be in a hurry to lower rates." He added, "The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully."

Earlier in the week, reports indicated that price increases made little progress toward the Fed's 2% inflation goal during October. These developments have spurred debate over how much the Fed will adjust interest rates in 2025 and raised questions about whether the central bank will cut rates at all in 2024.

As of Friday morning, market expectations for a 25 basis point rate cut at the Fed's next meeting on December 18 have decreased. According to the CME FedWatch Tool, there is now a nearly 55% chance of a rate cut, down from a 72% probability seen on Thursday. This shift reflects a growing acceptance that the Fed may not reduce interest rates as swiftly as previously anticipated, especially in light of strong economic indicators like retail sales.

The interplay between consumer spending, inflation, and monetary policy continues to shape the economic landscape as the year draws to a close. For now, the stronger-than-expected retail sales figures offer a positive signal about the health of the U.S. economy, even as uncertainties about future Federal Reserve actions persist.