50 Basis Point Rate Cut: What's Next For CRE?

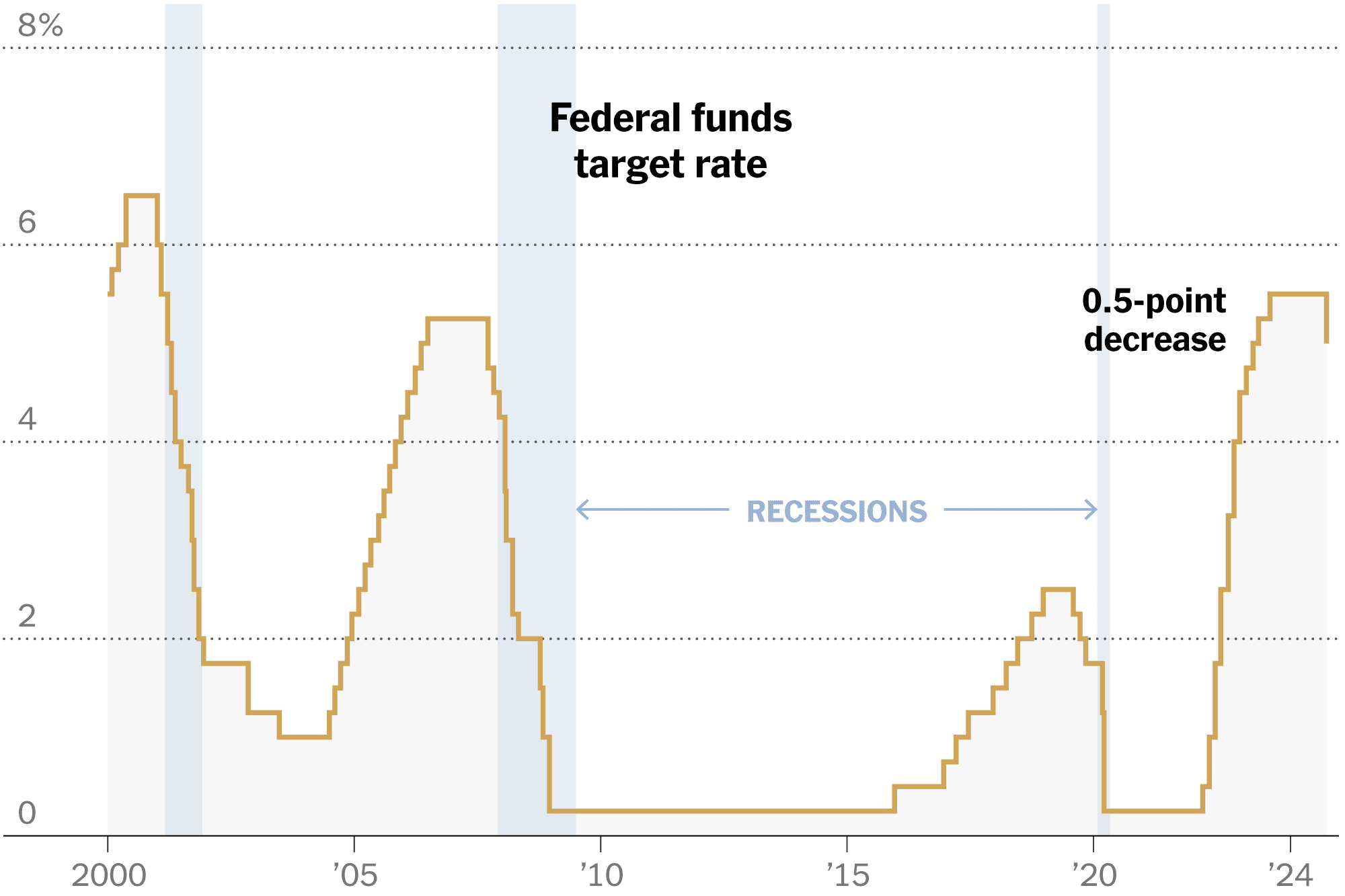

In a move that has been the subject of intense speculation, the Federal Reserve announced a significant 50 basis point (bps) cut to the federal funds rate. This decision marks the beginning of a shift from a restrictive to an accommodative monetary policy stance, a change that could have far-reaching implications for the U.S. economy and, notably, the commercial real estate (CRE) sector.

A Pivotal Decision Amid Economic Ambiguity

Leading up to the announcement, markets were divided on whether the Fed would implement a 25 bps or 50 bps cut. Mixed economic signals contributed to this uncertainty. Inflation has been cooling since its peak in the summer of 2022, but recent data indicates a slowing pace of disinflation. The Consumer Price Index (CPI) for August rose by 0.2% month-over-month and 2.5% year-over-year, down from 2.9% in July. While these figures suggest progress, they also highlight the complexities facing policymakers.

"While tremendous progress has been made in bringing inflation down since it reached its peak, the most recent inflation data have shown more mixed signals and a general slowing pace of disinflation," notes Omar Eltorai, Research Director at Altus Group.

Labor Market and Consumer Spending Trends

Employment data adds another layer of complexity. August saw employment increase less than expected, and job openings dropped to a three-and-a-half-year low in July. Conversely, the unemployment rate decreased to 4.2%, and average hourly earnings are forecasted to have increased by 0.3% in August after a 0.2% gain in July.

Consumer behavior is also shifting in ways that could signal economic caution. Reports from Citigroup Inc. indicate that consumers are focusing their spending on necessities rather than discretionary goods—a trend commonly seen during recessionary periods. There's also an uptick in credit losses as delinquencies rise.

"The average interest rate for new credit cards in July was 21.5%," adds Cole Perry, Associate Director of Research at Altus Group. "This becomes troubling when consumers start to use credit to purchase necessities. The cost of borrowing combined with inflation is still running hot, even though we’ve made progress in cooling it."

Implications for Commercial Real Estate

For the CRE market, the immediate effects of the rate cut may be more psychological than tangible. High borrowing costs and anticipation of rate cuts have kept transaction activity muted. However, the Fed's decision could boost investor sentiment, encouraging those on the sidelines to re-enter the market.

"The Fed Funds Rate is not the rate at which businesses, investors, or consumers borrow or access financing, so these effects will take time to flow through," explains Eltorai. "However, the signal sent by the first cut may be beneficial in the near-term, as this shift in policy stance can be factored into business projections, expectations, and valuations."

While a 50 bps cut is unlikely to spur immediate and significant excitement in CRE, it is a step in the right direction. "Ultimately, any reduction in the cost of borrowing will help the CRE transaction market and valuations," Eltorai adds. "Every basis point counts."

Looking Ahead

Investors are still pricing in at least two additional cuts at the upcoming Federal Reserve meetings in November and December. "Absent any shock to either capital markets or the economy, I’d anticipate that the Fed will aim to take a similar, gradual, and measured approach to cutting as they did to hiking," shares Eltorai. "These decisions will remain dependent on inflation data showing continued progress towards the Fed’s 2% target and labor market data showing resiliency."

If the Fed continues to lower interest rates by at least 25 bps at each of the remaining policy meetings in 2024, more noticeable movement in the CRE market may emerge at the start of 2025. "More important for CRE is what happens with the yields on U.S. Treasury securities," Eltorai points out. "As for the U.S. economy—at the moment, it appears that a soft landing is possible. However, the answer to this question will only become clearer over the coming quarters."

The Federal Reserve's 50 bps rate cut is a significant development with the potential to influence the commercial real estate market in the coming months. While immediate impacts may be limited, the psychological boost and the shift towards an accommodative policy could set the stage for increased activity and investment in the sector. Investors and stakeholders should monitor economic indicators and Fed actions closely to navigate this evolving landscape.